As the year 2017 ebbs, we have

some good news to cheer about: for the first time after 13 years, Moody’s

Investor Services, the global credit rating agency, raised India’s sovereign

rating from Baa3 to Baa2. Obviously, this is a welcome recognition of not only

the country’s economic potential to grow, but also the acts of the government

in putting in place the requisite structural reforms, such as the Goods and

Services Tax Act, Insolvency and Bankruptcy Code to facilitate banks wriggle

out of their bad debt problem with no further loss of time and recapitalization

of public sector banks that affords fresh credit delivery for

expansion/creation of production capacities, that are of course, long overdue.

Commenting

on the reforms that the government has so far undertaken, the rating agency said

that they would “advance the government’s objective of improving the business

climate, enhancing productivity, stimulating foreign and domestic investment,

and ultimately fostering strong and sustainable growth.” Cheered by this

announcement, the stock market that witnessed pressure for the last few days

has rebounded merrily. The forex market too reacted positively: rupee posted

handsome gains intraday.

This

upgrade also cheered the government for more than one reason: with our forex

reserves at a comfortable level, this upgradation sends a strong signal about

India’s economic stability, which in turn makes it easy for the government to

mobilize loans and that too, at cheaper rates. It also improves the borrowing

capacity of public sector undertakings and the blue-chip corporates from the

global markets at a cheaper price. Improvement in the rating will encourage

long-term investors such as pension funds to invest in Indian bonds.

Simultaneously, existing investors are likely to increase their allocations to

India. In short, this measure will boost confidence leading to higher capital

flows and allocations.

Elaborating

on the rationale behind the change in rating, William Foster, the Vice

President of rating agency said that “the government’s commitment to fiscal

consolidation remaining intact”, “over time, measures aimed at broadening the

tax-base and improving the efficiency of government spending” shall be able to

“contribute to a gradual narrowing of the [fiscal] deficit.” There is of course

a flip side to it, said Foster: “a material deterioration in fiscal metrics and

the outlook for general government fiscal consolidation can put negative

pressure on the rating."

As

against this, S & P rating agency retained India’s sovereign rating at the

lowest investment grade with a stable outlook citing weak fiscal position,

particularly of States; high government debt, and low per capita income at

close to $2000 in 2017—the lowest of all investment-grade sovereigns that they

rate—as the reasons. Intriguingly, it forecasted India’s economic growth to be

robust in 2018-20, though the growth in the last two quarters is lower than

expected owing to demonetization and introduction of the goods and services

tax.

With one

more rating agency, Fitch, still to announce its rating, there is of course, a

feel-good factor pervading the global financial markets about Indian economy,

for both the rating agencies have complimented the sitting government for its

reforms agenda, because of which there is every likelihood of capital-hungry

Indian businesses, particularly, lenders, enjoying the benefit of reduction in

the capital cost by about 100 basis points. Obviously, such a reduction in the

cost of debt funds for banks would mean a lot for the economy in general, more

so when the government is recapitalizing the banks for enabling them to make

fresh credit available to businesses.

There is

yet another positive to emerge out of the current upgradation of India’s rating

by Moody’s: the finance minister, who indeed said the other day, “no pause [on

fiscal consolidation] … but challenges arising from structural reforms … could

change the glide path”, is tied down to stay focused on fiscal consolidation

and the government to stick to reforms course—the allurement of elections

notwithstanding.

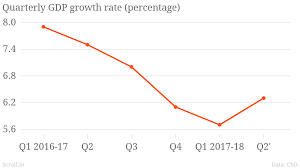

Another

welcome development that followed the rating up-gradation is the announcement of

the Central Statistics Office about the reversal trend in the GDP growth in the

2nd quarter of the current fiscal: GDP at

constant 2011-12 prices has grown by 6.3 per cent in the second quarter of

2017-18 as against 5.7 per cent in the previous quarter. It

certainly appears that the economy has at last shaken off from the side-effects

of note ban and GST.

Encouragingly, much of this growth in this quarter has

come from manufacturing sector. Of course,

there is a disturbing shade too: exports still continue to be anemic. Over it,

the GDP data per se has to be taken with a bit of caution, for Statisticians,

in absence of data such as sales tax receipts, have used such other methods as

nominal value of commodity output, increase in tax revenues from

petroleum-related products, etc. to arrive at the estimate.

Overall,

we certainly have something to cheer up and capitalize on in the New Year!

No comments:

Post a Comment