The Nobel Prize in Economics to Ostrom and Williamson—who have by their independent research taken economics beyond the traditional analysis of market prices by establishing ‘economic governance’ as a field of research—has come at the right time when the world is entangled in governance issues that have not only led to the collapse of organizations but also to worldwide contagions.

Neo-classical economics textbooks proclaim that markets endowed with private property rights and contracts are better equipped to deliver wonders—efficiency and equity. But in the real world, as is incidentally being experienced amid the ongoing global economic crisis, it does not happen that way, at least always. Even the prophet of market economy, Adam Smith, is perhaps aware of it when he said: “Creating harmony between the pursuit of self-interest and the pursuit of social welfare depends on the constraints on self-interest.” But the scope for the operation of such a ‘constraint’ on man’s behavior appears slim: for ‘Man’, as enunciated by grandsire Bhishma in The Mahabharata, is a slave to money—arthasya purusha dasah. The ongoing world economic crisis is, perhaps, a vindication of this prophecy.

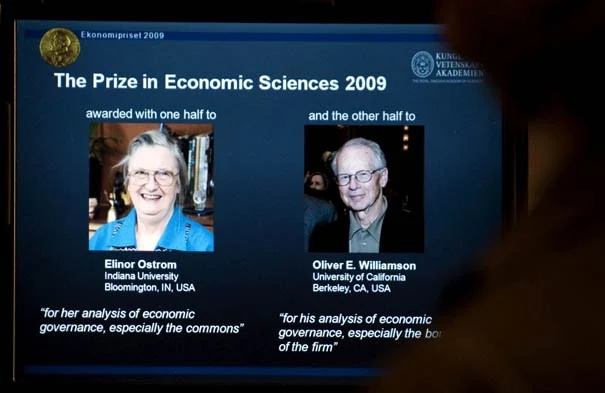

Fortunately, there are off-beat researchers of modern day who have analyzed as to why the world looks the way it does—different from the ideal world found in classical textbooks—and explained as to what works in it. It is to two of such researchers—Elinor Ostrom of Indiana University, Bloomington, US, and Oliver Williamson of University of California, Berkeley, US—that the Nobel committee has awarded the Nobel Prize in Economic Sciences for the year 2009. They share the prize for their separate research into economic governance—the rules by which people organize, cooperate, relate and exercise authority in companies and economic systems—that “advanced economic governance research from the fringe to the forefront of scientific attention.” The committee observed that their research revealed how economic analysis could explain most forms of social organization.

Ostrom, the first woman to win Nobel in Economics, is currently the Arthur F Bentley Professor of Political Science, at Indiana University, Bloomington. Her pioneering work mostly concerns the economic governance of the common pool resources—managing common resources such as pastures, woods, lakes, and fish stocks. Her research “has challenged the conventional wisdom that common property is poorly managed and should be either regulated by central authorities or privatized,” said the Nobel economics committee. Her findings, though sound commonsensical, are eye-openers, for they challenge Garret Hardin’s “The Tragedy of the Commons”—a living expression of neo-classical thinking—through their revelation that common resources are better managed from the bottom-up by user-associations than by the governments or the private sector. Ostrom went out to the field to study what people and communities are doing differently, and drawing new insights from it, proposed a new architecture of governance, which she dubbed ‘polycentric governance’. Based on her field research, Ostrom has prescribed new ‘design principles’ that could be used by people, communities, and societies facing real-world problems in managing local common pool resources: one, clearly defined boundaries; two, adapting rules regarding the appropriation and provision of common resources to local conditions; three, collective-choice arrangements; four, effective monitoring by monitors who are part of or accountable to the appropriators; five, a scale of graduated sanctions for resource appropriators who violate community rules; six, cheap and easy access mechanisms of conflict resolution; and seven, recognition of the self-determination of the community by higher-level authorities.

Her co-winner, Williamson, currently the Edgar F Kaiser Professor Emeritus at the Haas School of Business, University of California, Berkeley, is a pioneer in the multi-disciplinary field of transaction cost economies and has been awarded the Nobel “for his analysis of economic governance, especially the boundaries of the firm.” Williamson “developed a theory where business firms served as structures for conflict resolution”. He has argued that hierarchical organizations, such as companies, represent alternative governance structures, which differ in their approaches to resolving conflicts of interest. His ‘transaction cost theory’—developed based on the opportunistic behavior of agents who can renege on their commitments, bounded rationality of agents and asset specificity, where assets are only valuable in certain uses and certain economic relationships that offer a scope for the parties transacting with each other to engage in ‘holdup behavior’—indeed highlights the nature of real-world market organizations. It argues that “large private corporations exist primarily because they are efficient. They are established because they make owners, workers, suppliers, and customers better off than they would be under alternative institutional arrangements.” It also clarifies that “when corporations fail to deliver efficiency gains, their existence will be called into question,” which means firms cannot grow infinitely either. Admitting the fact that corporates are better equipped to handle the drawback—haggling and disagreement—associated with markets by virtue of their authority to ‘mitigate contention’, Williamson warns that the same authority can as well be abused. It also emphasizes the limited ability of people to make perfectly informed decisions, besides the propensity of some to act opportunistically. His research findings recommend that it is better to control such behavior directly rather than through policies that restrict the size of the corporates.

In sum, his insights help us understand better a broad range of organizational compacts such as the choice and design of contracts, ‘information impactedness’, corporate financial structure, the function and operation of political systems, and the size and scope of firms—the question of a firm going for vertical integration as defined by the scope for lowering the transaction costs; why some activities are carried out by large corporations, while others aren’t; and why big firms come into existence more frequently than is predicted by the neo-classical theory.

Interestingly, the Nobel award is a good thing to happen to Ostrom and Williamson who have by their independent research taken economics beyond the traditional analysis of market prices by establishing ‘economic governance’ as a field of research that has “greatly enhanced our understanding of non-market institutions,” that too at a time when the world is entangled in governance issues—failure of boards of directors to moderate excessive compensation or bonuses that encouraged excessive risk-taking, leading to not only the collapse of organizations but also worldwide contagions. Thus, their research highlights once again the need for a constant vigil over “man’s slavery to money”, as reflected in his behavior.

- GRK Murty

No comments:

Post a Comment