Rationalists see a rationale in the behavior of exchange rates. And they have immense faith in their own ability to theorize economic behavior. Hence, they postulate theories to define exchange rate behavior. They all sound logical in depicting the rationale. But markets are manned by ‘herds’. However rational one may be individually, no sooner he becomes a herd-member, he lets go rationality and sways with the herd. The net result is: exchange rate theories remain as theories and markets swing in their own (ir) rationality. Yet, there is a method in that madness…

Economists

often refer to exchange rate as the single most important price in an open

economy that has tremendous influence on many other macro level monetary and fiscal

decisions of countries across the globe. Guessing a correct Exchange Rate has,

therefore, become a critical input for market players. There are however two

predominant ways of explaining the behaviour of exchange rates: one, to look at

exchange rates from the perspective of its supply and demand position, and,

based on it, to analyze the behaviour of major market participants, and two, to

study the behaviour of aggregate variables such as expected inflation rates,

interest rates, etc. and accordingly take a view on market movement. Against

this backdrop, let us attempt to trace the impact of the various macro-economic

fundamentals and behaviour of market participants on the behaviour of exchange

rates.

1. Balance

of Payments

Balance of Payments is the summary of all international

transactions between residents of one country with the rest of the world

community. It represents the demand for and supply of foreign exchange, which

ultimately determines the value of the domestic currency. Factors like rate of

growth in GDP, savings and autonomous capital inflows from overseas markets,

etc., also impact exchange rates. Exports, both visible and invisible,

represent the supply side of foreign currency, while imports create demand for

foreign exchange. When the balance of payments position of a country is

continuously at deficit, it implies that the demand for the foreign currency is

more than its supply and, therefore, its currency depreciates in value. On the

other hand, if the balance of payments position is surplus, the currency gains

in value as we are witnessing with Rupee in the recent past.

Box 1: Balance of Payments – Basics

|

Balance of payments

is an accounting statement that summarizes all the economic transactions

between residents of a country and residents of all other countries. Currency

inflows are recorded as Credits and outflows as Debits. There are three

balance of payments categories:

Current Account : Records flows of goods, services and

transfers.

Capital Account : Shows public and private investments and

lending activities – indicates changes in foreign financial assets and

liabilities.

Official Reserves Account : Measures

changes in holdings of gold, foreign currencies – Reserve assets – by

official monetary institutions.

Balance of payments statement is based

on double entry book-keeping. Every economic transaction recorded as a credit

brings about an equal and offsetting debit entry and vice versa. For e.g. if

a foreigner sells a machine to an Indian resident the debit is recorded to

indicate an increase in purchase by India; a credit is recorded to

reflect an increase in liability to a foreigner.

Current Account

The balance on

current account reflects the net flow of goods, services and unilateral

transfers (gifts). It includes exports and imports of merchandise (trade

balance),military

transactions, and service transactions (invisibles). The service account

includes investment income (interest and dividends), tourism, financial

charges (banking and insurance), and transportation expenses (shipping and

air travel). Unilateral transfers include pensions, remittances, and other

transfers for which no specific services are rendered.

Exports are usually valued on f.o.b.

basis and Imports at c.i.f values. The net difference between the credits and

debits is known as balance on merchandise trade account – which could either

be deficit or surplus.

Invisibles

Traditionally, trade

in physical goods is separated from trade in services. Credits under

invisibles consist of services rendered by residents to non-residents, income

in the form of interest, dividend, royalties on patents and designs whereas

debits consist of payments to foreign technical consultants, revenue

contributions by Government of India to UN establishments, flight charges

made to non-residential steamships, airlines, etc.

The net balance between the credit and

debit entries under the heads Merchandise, Nonmonetary gold movements and

Invisibles taken together constitute what is called Current Account deficit

or Current Account surplus.

Capital Account

It indicates changes

in the country’s foreign financial assets and liabilities. These transactions

are usually grouped under sub-heads – Private, Banking and Official.

Private transactions

Includes long-term

loans received by private companies, investments by foreigners in the equity

of the Indian companies, repayment of long-term loans by Indian corporates,

etc.

Banking Capital

Covers foreign

financial assets and liabilities of commercial banks that are privately owned

or government owned. Assets consist of balances held by the banks in their

foreign branches or correspondent banks abroad and rupee assets representing

overdrafts granted by Indian banks to branches of foreign

banks/correspondents. Similarly, liabilities consist of Indian banks’ debit

balances in the foreign accounts and credit balances held by foreign banks

with banks in India.

Any increase in asset is a debit while a decrease in asset is a credit.

Official Capital Flows

Consists of transactions

relating to foreign financial assets and liabilities of Govt. of India and

Reserve Bank of India:

Credit entries under Loans consist of drawls by Govt. of India or loans

granted by foreign governments and debits consist of loans disbursed by Govt.

of India to foreign governments.

Balance of

Payments statistics are regularly compiled, published and are continuously

monitored by companies, banks and government agencies because they have both

short-term and long-term implications for a host of economic and financial

variables impacting exchange rates and interest rates of the country.

|

Current

account, one of the constituents of BOP, has a relationship with exchange rate

behaviour. When a country experiences current account deficit, it issues claims

to the assets acquired and in the process supplies more of its currency than

what the market demands. This situation leads to excess demand for domestic

currency as more goods and services are imported than exported. This imbalance,

in turn, leads to eventual depreciation of the domestic currency to eliminate

the excess supply in a floating rate environment. This depreciation makes

exports more competitive and consequently improves current account. By a

reverse argument, current account surpluses recede as the exchange rate

strengthens, again bringing about an automatic correction in the exchange rate.

The foreign

exchange reserves that are held by central banks are in terms of foreign

currencies, gold, and other investments, SDRs, etc., indicate the ability of a

country’s central bank to maintain its currency at a desired exchange rate.

Countries with a surplus in their current account usually build-up reserves to

enjoy the benefits of a strong currency which is anti-inflationary, besides

making imports cheaper and thereby compel domestic manufacturers to price their

products at current price. But technically speaking in a system of truly

floating rates, there is no need for the central banks to maintain reserves

since any disequilibrium between supply of and demand for foreign exchange

tends to settle on its own through changes in the relative values of

currencies.

To better

appreciate the role of governments in the foreign exchange market, one has to

understand the complexity of multiple objectives being pursued by the

governments. It is also essential to appreciate that pursuit of one objective

leads to the sacrifice of the other. For instance, if creation of high

employment is the objective, governments usually practice a combination of

expansionary monetary policy and fiscal deficit. This measure leads to a high

level of inflation that, in turn, impacts the balance of payments, which means

exchange rates. The relationship between macro-economic factors, current

account and exchange rate behaviour is summarized below:

2. Inflation

It has multi-dimensional effect on the exchange rate

movement, for it not only moves exchange rates but also interest rates. For

that matter, one simple channel that links interest rates with exchange rates

is the effect of inflation. Since nominal interest rates depend on expected

inflation, and nominal exchange rate depends on relative rates of foreign and

domestic inflation, an inflation shock will affect both nominal interest rates

and exchange rates. Inflation shocks can usually be expected to lead to a

negative co-relation between nominal interest rates and exchange rates. For

example, if money supply increases, increased inflation will become the norm.

To the extent higher inflation is built into inflation expectations, nominal

interest rates will tend to rise. And, if inflation exceeds inflation in

foreign countries, the nominal exchange rate will tend to fall.

Similarly,

deflationary policy could lead to a negative relationship between interest

rates and exchange rates. A reduction in the inflation that leads to lower

inflation expectation, could tend to reduce nominal interest rates. And, if

inflation rate is lower than foreign inflation rate, domestic products will

become more attractive in international markets resulting in forex inflows that

make the rupee tend to appreciate. Similarly, increase in inflation increases

the domestic prices leading to exports becoming less competitive. As a result,

exports fall; with it the demand for currency declines resulting in the decline

of external value of currency. To sum up, it is the relative rate of inflation

in the two countries that causes changes in exchange rates.

3. Interest

Rates

As seen under Fisher relationship, changes in real

interest rates are translated directly into change in nominal interest rates.

Secondly, it is the changes in real interest rates that alter relative

attractiveness of the domestic or foreign investment opportunities. This, in

turn, causes movements in real and nominal exchange rates. For instance

consider a FII with the choice of investing in Indian or in his domestic

assets. The exercise of the choice rests on two critical inputs:

- One, a comparison between relative real interest rates, and

- Two, as the assets are denominated in different currencies, investor could also consider differences in the real exchange rates since it affects the ultimate return.

So, any

expected appreciation of the real value of the Rupee represents an expected

capital gain and adds to the Indian real return, making an overseas investor to

prefer investment in India.

Similarly, any expected depreciation of real value of the Rupee represents a

capital loss and lowers the Indian real return.

Generally,

market forces should equalize the real returns to investment in the two

countries[1].

But usually, market forces equalize the real returns to investments in the two

countries. That means –

Indian real

interest rate |

+

|

Expected

appreciation of

real exchange rate |

=

|

Foreign real interest rate

|

In other words,

if the Indian real interest rate is higher than the foreign real interest

rates, the market usually expects the real exchange rate to depreciate. Thus,

the expected deprecation of the real exchange rates offsets the higher real

interest rates and the real return from Indian investment equals the foreign

real return. To sum up, the expected appreciation or deprecation of the Rupee

is directly related to the real interest rate differential in the two

countries.

Box 2: Real Exchange Rates

|

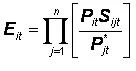

A general expression

for the effective real exchange rate of country i(Ei) is

given by.

Where,

Pi measures

the domestic price level in country i;

P*j

the foreign price level in country j;

Sij is

the relevant nominal exchange rate (defined as foreign currency per unit of domestic

between country i and j); and

is the weight of country j in country i’s effective exchange rate index. is the weight of country j in country i’s effective exchange rate index.

As such an

increase in Ei implies

that the currency has appreciated, or alternatively that it has become less

competitive.

|

Source: Rebecca L

Driver and Peter F Westaway, Concepts of equilibrium exchange rates, Working

paper no.248, Bank of England.

|

In this

framework, an increase in the Indian real interest rate will lead to the

increase in the real exchange rate and the nominal exchange rate. A higher

Indian real interest rate increases the attractiveness of Indian assets,

leading to an increase in the demand for Rupee denominated assets which, in

turn, lead to appreciation of the real exchange rates. Then, for given price

levels at home and abroad, the nominal exchange rate also tends to rise.

There is yet another

way of looking at the whole relationship: an increase in the Indian real

interest rate leads to an increase in the real exchange rates. But as per the

equation given above, the total real return from the Indian asset must equal

the foreign real interest rate. Hence, a rise in the Indian real interest rate

relative to the foreign real interest rate must lead to an expected

depreciation of the real exchange rate. Therefore, if we assume that the real exchange

rate is constant in the long run, the market simply expects the real exchange

rate to depreciate to future, for which real exchange rate has to appreciate

today. William Branson (1985) said: “what must go down in the future (an

expected depreciation), must go up today (the current real exchange rate)”[2].

4. Money

Supply

Like the price of any commodity, the price of money too

is determined by the laws of supply and demand. When the supply of money is

less than the demand for funds, interest rates increase. Similarly, when the

supply of funds exceeds the demand, the interest rate decreases. It is the

central banks of the countries that usually control, of course within certain

limits, the growth of the country’s money supply. This is often done through

changes in the discount rate. However, what is not clear is the impact that a

change in money supply will have on the level of interest rates. For example,

in periods of relatively low inflation rates with ample idle capacity, what is

perhaps needed for the market to absorb the increase in money supply is lower

interest rates, as is being witnessed currently in our country. On the other

hand, if inflation rates are already high, the increase in money supply calls

for increase in interest rates to contain rising inflation. Thus, it is the

‘situation’ that defines the impact of money supply on interest rates and, in

turn, the exchange rate behaviour but not ‘money supply’ per se.

5. Capital

Movements

Short-term movement of capital may be influenced by the

interest rate structure. If interest rate rises, there will be an inflow of

foreign capital and as a result of increased supply of foreign currency, the

exchange rate of the rupee will rise. If interest rate falls, there will be

outflow of capital and therefore, the exchange value of the rupee will fall.

Bright

investment climate and political stability may encourage portfolio investments

in the country. This leads to a higher demand for Indian securities leading to

an appreciation of the rupee. Poor economic outlook, on the other hand, may

lead to repatriation of investments leading to decreased demand for Indian

securities which, in turn, depreciates the value of rupee.

6. Private

Speculations

The purchase of foreign exchange for profiting from an

expected fall (rise) in the domestic exchange rate – which in the market

parlance is termed ‘speculation’, is considered the prime cause for much of the

volatility in exchange rates. In other words, volatility is stemming from the

actions of speculators rather than from changes in the factors that determine

the equilibrium exchange rate. For instance, a fall (rise) in the exchange rate

leads speculators to think a further declaim (increase) is imminent. Driven by

this belief they sell (purchase) domestic currency and thus drive its price

further down (up). In view of this, speculation is considered a destabilizing

force that magnifies deflections in exchange rates[3].

There is,

however, another view: speculation is considered a stabilizing force. To make

profits, speculators must buy when the exchange rate is below its equilibrium

level and sell when it is above its equilibrium level. Thus profitable

speculators push the exchange rate towards equilibrium rather than away from

it.

7. Central

Bank’s Intervention

Ever since floating rate regime commenced in 1973,

world’s central banks, including RBI, have intervened frequently and at times

forcefully in the forex market to influence the path of their respective

currencies’ movement/stability as also in the interest of their monetary

management. Policy makers have a variety of tools at their disposal to

influence the exchange rate movement viz. – monetary policy; and control on

capital movement etc. But the immediate reaction of central banks to any market

dislocations is to intervene either in the spot market or forward markets or in

both, at the same time.

Though

intervention in the spot market serves the objectives of Central Bank, such

sudden intervention makes market makers’ job/task that much more difficult. Its

intervention is simply based on the philosophy that whenever the demand and

supply of any foreign currency puts pressure on the exchange rate, there arises

a need for the central authority to satisfy the excess demand or to remove the

excess supply by intervening and putting into the market some of the foreign

currency from its own stocks or by taking the excess into its stock.

Similarly, it

also intervenes in forward market, though it is a topic of considerable

dispute. One argument is that it is essential for the central bank to intervene

in forward markets for managing domestic interest rates and thereby inflow and

outflow of money. At times, it may also intervene on a substantial scale to

reduce the pressure of speculation on the home currency, but this is often

doubted by market players. Its main disadvantages are: it tends to make the

task of the speculator easier by cheapening the cost if he is mistaken, without

seriously reducing the profit if he is right and second, it puts tremendous

burden on the intervening central bank in terms of cost. Admittedly, if the

speculation is unjustified, there is no doubt of profit for the central bank in

the operation but, if the speculation turns out to be justified, the central

bank may have to really bleed.

Sterilized vs.

non-sterilized intervention from the Central Bank is another critical factor

that has far reaching effect on exchange rates. The general purpose of each

intervention of Central Bank is to increase market demand for one currency by

increasing the market supply of another. In the process, it leads to increase

in the supply of domestic currency and all other things held constant, it leads

to high inflation. Therefore, such intervention not only changes the exchange

rate but also the inflation rate and, in turn, interest rates. So an intervention

has to be always through open market operations so that the excess liquidity

from the system can be absorbed by way of issuing Treasury Bonds, etc. So a

sterilized intervention is quite imperative.

All said and

done, Central Bank intervention operations do still exert a short run impact on

exchange rates. In benign market conditions, intervention can exert a marked

influence on the trend of exchange rates. But under turbulent conditions like

what was witnessed during the Asian crises, when massive flows of speculative

capital moved from one group of currencies to another, virtually no concerted

intervention effort of any central bank can succeed in holding the line.

8. Exchange

Rate Movement in the Short-run

The National Bureau of Economic Research carried out a

study on "How do UK-based Foreign Exchange

Dealers Think Their Market Operates?", addressing three issues[4]:

- The microeconomic operation of the foreign exchange market, like trading techniques and mechanisms;

- Traders’ views on the relevance of fundamentals in explaining the changes in exchange rate determination and its strengths in predicting the future exchange rate movements; and

- Importance of microstructure factors in studying rate changes.

It conducted a

primary survey of 110 UK-based foreign exchange dealers during March-April 1998

and the results are very interesting:

- There is a huge and significant shift from fundamental to non-fundamental factors.

- There is a unanimous belief that fundamentals are irrelevant in intra-day trading.

- There is a belief that news (32.8 percent out of 110 respondents), bandwagon effects (29.3 percent) and speculative effects (25.3 percent) are more important in the intraday market,

- Only 0.6 per cent felt that fundamentals are useful in intra-day trading.

- As the horizon lengthens the use of fundamentals rises, but with more risks.

- Speculative forces which traders measure from the order flows (synonym of effective demand) through the market were highly ranked in intra-day trading and that is the only factor perceived to play a significant role in both intra-day and medium-term trading.

It thus becomes

evident that in intra-day and short-term trading, macro theories on exchange

rate determination are of less use for dealers. Similarly, long-term

predictions are also not of much use as dealers perceive that they need to face

more risk in long run trading. It is therefore necessary to capture the impact

of speculative forces on the intra-day and short-horizon business in the

foreign exchange market.

In financial

market literature, to study speculation and uncertainties, researchers usually

apply the market microstructure theory. It deals with the behavior of

participants in asset markets and the effects of information and institutional

variables – such as technology, price information, the matching of buyers and

sellers, optimal dealer pricing policies, “news” and transaction costs;

non-synchronous trading, etc on the performance of the market.

The microstructure theory basically consists of two

models:

- Inventory model – aims at optimizing the problem as the dealers’ objective is to maximize the expected profit per unit of time. It emphasizes the control of inventory fluctuations through price adjustments to avoid bankruptcy and failure at the end of dealing. It also explains the relationship between the transaction cost and bid-ask spreads. But failure occurs in this model whenever the dealer runs out of either inventory or cash.

- Information model is based on adverse selection problems; explains the behavior of market prices through information content of trading activities. Since there is asymmetry of information between the dealers, their behaviour in deciding the price will be different; it explains ways to arrive at the equilibrium market price in the presence of asymmetric information.

Looking to

these developments in the global markets, there is a lesson to be learnt: international

banking divisions of banks must have research wings for proper predictions of

intra-day and short-term movements in the exchange rate to help dealers trade

even in a thin market and with small spreads.

We have studied forex markets, their

structure, players, dealing mechanics, exchange rate behaviour, underlying

theories, and the role of Central Banks in exchange rate management. Now from

this platform let us move on to examine the impact of foreign exchange exposure

on the cash flows of companies and how foreign exchange risk is hedged.

- Excerpts from Currency Market Derivatives, GRK Murty, IUP Books, Hyderabad, 2006.

***

[1] By Craig S. Hakkio, Interest Rates and Exchange Rates – What is

the Relationship? – Economic Review,

November 1986, Federal Reserve

Bank of Kansas City.

[2] See Willam H. Branson, “Causes of Appreciation and Volatility of

the Dollar.” The US Dollar – Recent

Developments. Outlook and Policy

Options, proceedings of a conference sponsored by the Federal Reserve Bank of

Kansas City. August 21-23, 1985, and Craig S. Hakkio and J. Gregg

Whittaker.“The U.S. Dollar – Recent Developments. Outlook and Policy Options.”

Economic Review, September/October 1985. Federal Reserve Bank of Kansas City,

pp. 3-15.

[3] Douglas K. Pearce – Alternative Views Of Exchange Rate

Determination. Economic Review, February 1983; Federal Reserve Bank of Kansas

City.

[4] NBER Working Paper, 7524. How do UK-based Foreign Exchange

Dealers Think Their Market Operates?’ ... Yin-Wong Cheung, Menzie D. Chinn Ian

W. Marsh, February 2000.

No comments:

Post a Comment